Well whaddaya know ... the average American pays more in tax and social security than Canadians, Australians, the Japanese and the British.

But when you compare the American tax burden to other developed nations, the numbers don't look so bad.

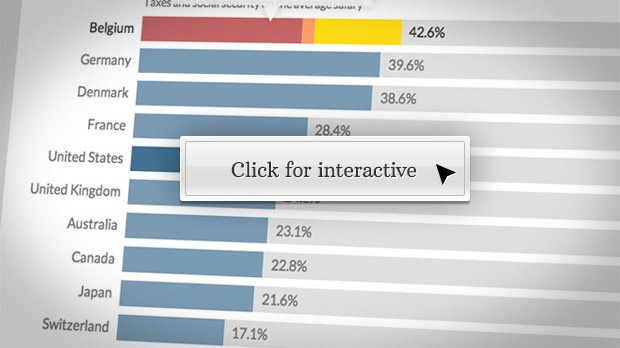

New data from the Organisation for Economic Co-operation and Development compared tax rates and social security deductions on average incomes in 34 countries.

The data shows that Belgians, Germans and Danes have the highest tax burdens, while South Koreans, Mexicans and Chileans have the lowest. Americans are about in the middle.

The OECD made the comparison by taking the average annual salary in each country and then subtracting federal and local income taxes, as well as employee social security contributions. The researchers used as their benchmark a single worker who did not have any kids or dependents.

When you crunch the numbers, the tax burden for an American worker making the average wage -- $48,463 -- is a touch below the global average. Americans pay 24.6% of their salary in income taxes and social security, allowing them to take home about 75% of their gross pay.

No comments:

Post a Comment